I’ve been investing for almost 20 years now and worked professionally in commodity fundamentals and risk management for 15 of those years. For anyone who’s worked in commodity trading, you know how cutthroat it is and how critical the need is to make right calls with appropriate hedging mechanisms in place. Being a fundamentals analyst has served me well and I am able to view a position holistically without any bias, but of course that took years of learning and many mistakes until I could confidently hone it. In this blog I will talk about how I approach optimizing my portfolio to reduce risk and reach for above-average returns.

Portfolio Optimization

Target Assets

The number and type of assets available to invest in is extremely large and can overwhelm investors. I don’t like to get into exotic investments or assets I don’t understand well. There may be exceptions such as cryptocurrencies or blockchain technologies as they tend to drive efficiencies and there should probably be some room in one’s portfolio to invest in these, as I have learned, it is imperative to keep an open mind when it comes to investing.

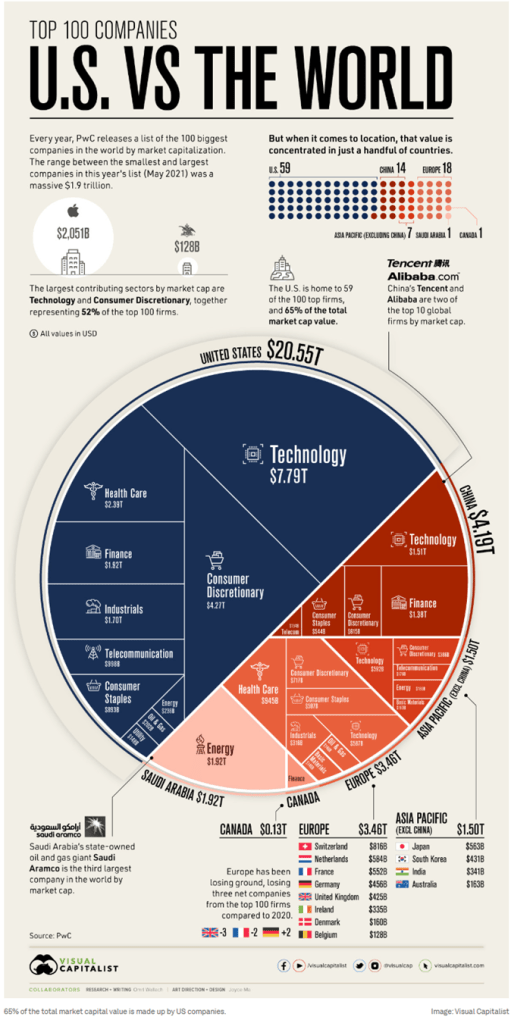

For the sake of this blog and my own portfolio, I will limit the world of assets to U.S. equities only. Why is that? It’s simple. The U.S. has hundreds of years of entrepreneurial history evidenced by the fact that the U.S. is the largest contributor to global economic value added. There is a long, rich history of American companies solving problems fast and at scale and no other country, including China, has measured up to the amount of value the U.S. has created. Some may debate this point but as along as the Chinese Communist Party is in power and attempts to control their markets with a heavy hand, this is unlikely to change anytime soon. The figure below illustrates this point perfectly.

Target Returns

In my portfolio, I look for companies with asymmetric risk/reward profiles over the long-term (5+ years). I would rather spend a significant amount of time finding 10 companies that could return $3 for every $1 invested knowing I could lose $0.20 per dollar rather than investing in 100 companies that could return $1.20 for every $1 invested. I prefer to spend my time learning deeply about a few companies or industries and leveraging my expertise than to reach outside my sphere of knowledge. Healthcare companies are a great example of a type of equity I will never add to my portfolio simply because it is just outside the realm of what I read everyday.

Risk Calculation

Knowing your risk exposure is important. Taking too much risk for insufficient return is not an acceptable strategy. The goal of every investor is to maximize returns while taking as little risk as possible. In the table below I’ve outlined some key metrics for both TPL and MPWR in comparison to each other as well as in comparison to an equity benchmark, SPY using price data from January 18th 2024 to January 17th 2025.

| Metric | TPL | MPWR | SPY | |

| 1 | Price correlation to SPY | .927 | .107 | n/a |

| 2 | Price correlation to each other | -0.123 | n/a | |

| 3 | Standard deviation of returns | 0.0296 | 0.034 | 0.0081 |

| 4 | Covariance of daily returns to SPY | 0.000068 | 0.000169 | n/a |

Some key takeaways from this table include:

- Sufficient diversification in the portfolio as TPL and MPWR have nearly 0 correlation.

- There is still some price correlation with SPY as TPL is an oil & gas equity so will naturally move in correlation with respect to health of the economy which is largely underpinned by commodity prices.

- We are taking on more risk than what is experienced by buying an index ETF, SPY but at the same time the portfolio’s volatility is limited to 3%-4% daily. This is sufficient risk to take on in return for double digit returns.

- Covariance of daily returns of each of these equities compared to SPY are not correlated.

Last Thoughts

This short blog highlights how I’ll be thinking of the portfolio going forward but that doesn’t mean I won’t necessarily be adjusting throughout the year as market dynamics change. The most interesting things to watch this year include:

- Interest rates and inflation

- Deregulation

- Geopolitics and how the U.S. positions itself compared to the rest of the world

- Impacts of machine learning, AI, and LLMs

- Infrastructure spending (data centers, energy, etc.)

Leave a comment