Monolithic Power Systems

Quick Thesis: Long track record of efficient operations and customer-centric innovative solutions are what enable this company to consistently deliver quality double-digit returns. Stock price recently dipped due to “near-term outlook” concerns and dropped another 15% yesterday due to a report from Edgewater Research claiming Monolithic is losing share in NVIDIA’s Blackwell GPUs. Monolithic leadership has not commented on this report at this time and other analysts have stated they are also not aware of any such issues. This company has a 20+ year record of consistent performance all under the current CEO and founder, Michael Hsing. The stock has dropped to $674 as of market close yesterday, but I believe long-term growth and value still remain. Read below for more.

10-year return: 1,625%; 5-year return: 374%

Biz Overview

As stated from their 10k, Monolithic Power Systems Inc. (NASDAQ: MPWR) is a “fabless global company that provides high-performance, semiconductor-based power electronics solutions.”. This essentially means they design the semiconductors that their customers buy but they outsource the manufacturing to a third party. This has both advantages and disadvantages but the key advantage is that MPWR has lower capital expenditures and can focus on R&D and deliver innovative solutions to their customers. Many other companies like NVIDIA, Qualcomm, AMD, and Broadcom also follow this approach.

MPWR’s mission is to “reduce energy and material consumption to improve all aspects of quality of life and create a sustainable future” and they differentiate themselves by “offering solutions that are more highly integrated, smaller in size, more energy-efficient, more accurate with respect to performance specifications and, consequently, more cost-effective than competing solutions.”.

MPWR focuses on the analog and mixed-signal integrated circuit markets which differs from digital integrated circuit markets, but its markets are wide and diverse. Below are MPWR’s revenue by end market and application as of end of 2023:

Its competitors include Analog Devices, Infineon Technologies, NXP Semiconductors, ON Semiconductor, Power Integrations, Renesas Electronics, ROHM Semiconductor, Semtech, STMicroelectronics and Texas Instruments.

Growth Metrics

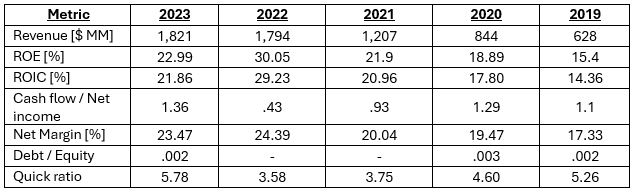

Here are some of the key metrics to consider. In general, I like to look for management’s ability to increase return on equity and invested capital, rely little on debt, and have ample liquidity to handle volatile times. Though this snapshot is over the past 5 years, if you go back further in time you’ll see improvement across all these metrics since the beginning of MPWR’s formation.

I can’t say I like any single thing here the most, but I do like to see that management is disciplined about managing debt and cash and being able to consistently return value to shareholders year after year.

Moat

MPWR is very clear about their value proposition AND it’s in their name! Monolithic circuits refer to integrated circuits where all components (transistors, resistors, capacitors, etc.) are fabricated onto a single piece of semiconductor. They do this through their proprietary bipolar-CMOS-DMOS (BCD) process technology which is now in its sixth generation. The combination of these three components results in a product with higher power density and configurability than a three-component solution. Monolith focuses on highly integrated power management chips which provides superior levels of reliability and convenience for their customers which subsequently results in high switching costs.

Risks

The greatest risk to MPWR is its exposure to China. A third of their revenue comes from Chinese customers and a portion of their manufacturing relies on Chinese foundries (with the remaining in Taiwan, South Korea, and Singapore). Given Donald Trump has won the most recent Presidential election, one can expect increased pressure on Chinese imports which could raise the cost of Chinese imported products as well as put pressure on Chinese consumers. Beijing, however, has been watching U.S. elections closely and recently revealed a $1.4 trillion financial package to boost the economy. It’s also worth noting that MPWR stock price performed well even during Trump’s first term, gaining approximately 300%.

Sustained Alpha

What really makes MPWR so attractive is the company’s consistently high return on equity and invested capital, extremely low debt levels, and high customer switching costs. The current CEO is Michael Hsing and he’s been with the company for 27 years. Unless there is a dramatic change in leadership, I expect MPWR to continue to generate above average returns.

Leave a comment